Of course, if you do get an invite, a $2,500 annual fee probably isn’t a big concern, but most cardholders may end up paying more for the bragging rights that come with the card than any tangible benefits the card actually provides. The high cost of membership is another major con. Its exclusivity means that many people who would love to have one will never get an invite. One big downside of the American Express Black Card is that you can’t just get the card if you want it. > Read More: Credit cards with the best concierge services Downsides of the American Express Black Card The concierge service can help you get unprecedented access to special events, concerts, and hard-to-get reservations at elite restaurants around the world. Concierge Serviceįinally, you’ll get access to a 24/7 concierge service that you can ask for just about anything. The card also comes with access to Centurion Lounges, personal assistance getting through customs and immigration routines at international airports, a $200 airline travel credit, a fee credit for Global Entry or TSA PreCheck applications, and a host of different travel insurance policies.

AMEX CENTURION FREE

These status tiers give you great benefits like free room upgrades, free flight upgrades, priority boarding, and priority for car rentals. Reportedly, carrying this card automatically qualifies you for a number of different elite travel clubs, such as Platinum Medallion Status with Delta Airlines, Diamond Status with Hilton, just to name some examples. This is a lower rewards rate than even some free credit cards, but of course, people sign-up for the Black Card for its other perks.

Surprisingly, cardholders report they receive a low rate of 1 Membership Rewards point per $1 spent on most purchases and 1.5 points per $1 on purchases of more than $5,000.

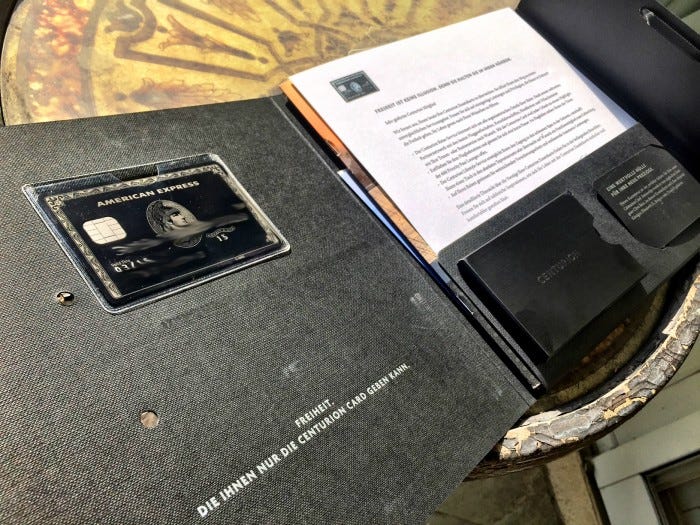

But it’s still an elite group.Īmerican Express is pretty tight-lipped about the rewards and benefits that come with the Centurion card, but cardholder reports give us a good idea of the kind of benefits these elite cardholders enjoy. That said, there is both a business and a personal card option and more people are likely to qualify based on their business expenses. While it’s never been stated publicly, rumors have it that users likely spend as much as $350,000 to $450,000 per year on their cards in order to qualify. Next, you have to spend a significant amount of money on your card each year. First, you have to already be an Amex user in order to qualify. While the card is invite-only, there are some things you can do to increase your likelihood of getting an invitation. It got the “Black Card” moniker because the card is made of black anodized titanium.

What Is the Official Name of the American Express Black Card?ĭespite the fact that the card is known colloquially as the Amex Black Card, the storied charge card is officially named the Centurion® Card from American Express.

0 kommentar(er)

0 kommentar(er)